Know Your Insurance Plan

Learn the important things to know about the NC Conference Insurance plans and programs.

Categories

Use the categories below to browse our facts.

1

Active Ministry & Employment

2

Retirement & Medical Leave

3

Bonus Facts

4

Contact Us

Active Ministry or Employment

Eligibility for Conference Insurance Plans

Clergy eligibility for life insurance plans is based on meeting all three of the following criteria:

- Work a minimum of 30 hours per week

- Have an appointment percentage of 1/2 time or greater

- Line 7 of the Clergy Compensation Worksheet must indicate a Plan Compensation equal to or greater than one-half of minimum full-time salary (clergy only) [2024 Line 7 must be equal to or greater than $24,922]

Clergy eligibility for HealthFlex insurance plans is based on the following criteria:

- Have an appointment percentage of 1/2 time or greater

- Work a minimum of 30 hours per week

Lay eligibility for life and HealthFlex insurance plans is based on working at least 30 hours per week.

Clergy appointed to Medical Leave must:

- Have been enrolled in the plans on the date immediately preceding your appointment to Medical Leave

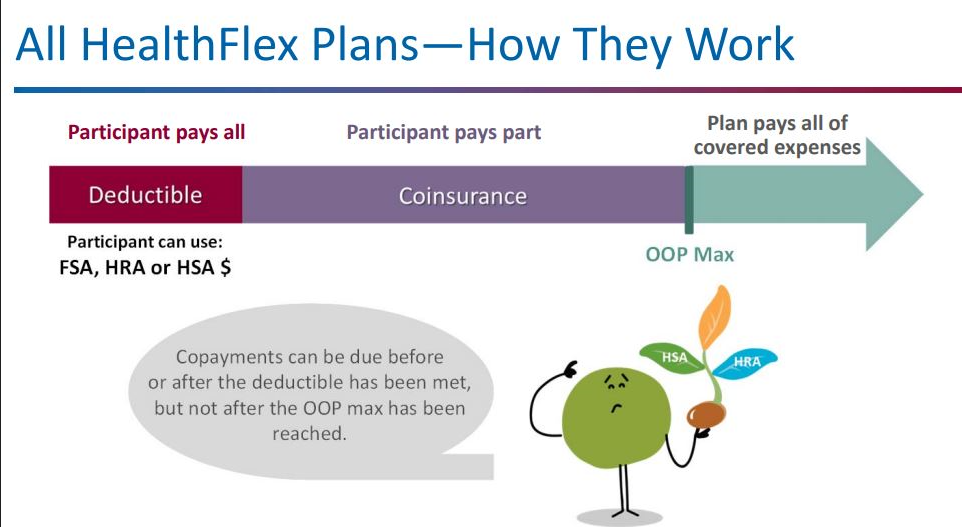

HealthFlex Plans and Provisions

The 2023 HealthFlex Plan Comparison highlights key differences and similarities between the various plans. The 2024 HealthFlex Plan Comparison (Spanish, Korean) is now available as well.

Current Participants in the HealthFlex insurance plans can visit BenefitsAccess.org to learn about their elections and benefits.

Check out these brief Benefit Bites videos to learn more about how HealthFlex works:

- HealthFlex Overview with Care Coordination (2:48)

- HealthFlex Plans (4:04)

- Health Account Differences (3:16)

HealthFlex Prescription Coverage

The HealthFlex Prescription coverage is designed with patient safety and cost containment in mind. Prescriptions for 30-days or less that are not maintenance (long-term) medications can be filled at any in-network pharmacy. After three 30-day fills at any in-network pharmacy for a daily medication (same dosage for all fills), then it is required to switch the medication to being filled by OptumRX Home Delivery or Walgreens. This requirement applies only to maintenance medications (90-day prescriptions). If these providers are not used, the member will pay the full discounted cost of the medication.

Dental & Vision Coverage

This Dental & Vision Plans webinar recording introduces participants to these coverages, options, and benefits.

The Dental DHMO network is a narrow network of providers. Before making this election participants should Find a Dentist in the Dental HMO plan to see if their current or prospective dentist is in-network.

You’ve Got a Deadline to Make Changes to Your Coverage

You must notify the Benefits Team within 31 days of any change that would affect your eligibility or enrollment in the Conference insurance plans. Examples of such changes include the birth of children, marriage, divorce, death, or loss of spousal coverage.

Will Preparation Services for Participants in the Supplemental Life Insurance Option

Everyone needs a will. Having a will prevents unnecessary stress, ensures your final wishes are clear, and is an ultimate way to express your care to your loved ones. Enrollees in the Conference’s Supplemental Life Insurance plan through MetLife, can take advantage of Will Preparation services. These services provide access to a network of attorneys who prepare and update wills, living wills, and powers of attorney. You may also use a non-participating attorney and receive reimbursement for covered services according to a set fee schedule.

Care Coordination

Starting January 2, 2024, Care Coordination is an exciting new service included with your HealthFlex coverage that will make your health care journey easier. With one phone call (no phone tree or complicated menu), you’ll be connected to a dedicated team of nurses, claims specialists, and benefits experts to get your health care questions answered. Care Coordinators can help you do things like:

- Answer questions about your benefits and claims

- Find in-network providers

- Review your care options and verify coverage

- Help you save on out-of-pocket costs

No request is too big or too small for your Care Coordinators. They will do whatever it takes to help you understand and use your health benefits.

Watch this short video and read these FAQs to learn more about how Care Coordination can help you in the new year.

Annual Election Period

The Annual Election Period is the time for current and new enrollees to make their benefit option elections for the coming new year. This period for establishing 2024 benefits will begin on November 1, 2023, and will be open until 11:59 p.m. on November 16, 2023. No enrollment or election changes will be accepted after this date.

Visit BenefitsAccess.org during the Annual Election period to make your choices for next year. If you’ve never used Benefits Access, click New User Registration. Call 1-844-688-1375 Monday-Friday 8 am – 8 pm EST between November 1 – 16, 2023 for support.

The ALEX Benefits Counselor tool is the best tool to help participants select their plans and estimate health account contributions. As it is used by 30+ Annual Conferences, it is programmed to display rates according to general Wespath rules. For church and personal rates specific to the NC Conference visit our Rates webpage.

It’s not too late to watch an Annual Election Educational webinar! Register at the links below to watch a recording.

- 2024 HSA Plan Changes for H1500 Enrollees

- 2024 HSA Plan Changes for H2000 Enrollees

- 2024 HSA Plan Changes for H3000 Enrollees

- Annual Election Overview

- Prescription Drug Coverage Overview and Q&A

- Annual Election Q&A

For Basic and Supplemental Life insurance choices, complete the NC Conference’s Annual Election Form.

Want to enroll in the conference insurance plans for the first time? Contact the Benefits Team at benefitsteam@nccumc.org to request an enrollment form.

2024 Insurance Rates

Both church and personal costs for 2024 insurance plan coverages are posted on our Insurance Rates webpage.

Basic & Supplemental Life Insurance

Your salary-paying unit provides for the Basic Life Insurance benefits. Each participant in the Basic Life program may also elect to enroll in the voluntary Supplemental Life Insurance plan. Rates are withheld from the participant’s salary on an after-tax basis and remitted by the salary-paying unit.

Your Insurance Enrollment Impacts Your Medical Leave Benefits

Enrollment in the Conference insurance plan immediately preceding the effective date of a Medical Leave determines eligibility for Conference insurance benefits after the appointment to Medical Leave.

Your Insurance Enrollment Impacts Your Retirement Benefits

Post-retirement health plan funding will be determined using years of NC pension credit accrued through June 30, 2009 plus the number of months of active enrollment in the Conference insurance plan between July 1, 2009 and your retirement date. Retirees must have a minimum of 180 months of combined credit over the course of their career to receive the minimum funding in retirement. Refer to the Board of Pension report in the Conference Journal for more details.

Ways to Wellness

The NC Conference offers a wellness program to support conference members in making their personal wellness a priority. The programs described on our Wellness webpage are offered as resources on your journey towards healthy living.

Health Accounts

Learn about the benefits of Health Accounts by watching this introductory Health Accounts webinar recording.

Helpful references when making your Health Account elections:

The IRS 2024 limits for contributions are listed below for the following health accounts:

- Health Flexible Spending Account – $3,200 maximum

- Dependent Care Flexible Spending Account – $2,500 for married filing separately and $5,000 for married filing jointly

- Health Savings Account (plan sponsor + your money):

- $4,150 (self-only)

- $8,300 (family)

- Individuals over 55 may contribute an extra $1,000 annually

- HealthFlex Health Reimbursement Account – no limit

Retirement & Medical Leave

Insurance Participants On Medical Leave Will Have a Benefits Change At Age 65

Insurance benefits for clergy on Medical Leave will be calculated as if you had retired on the first of the month in which you turn age 65. Your coverage under the NC Conference Blue Cross Blue Shield medical plan will end on the last day of the prior month. In the 90-day period prior to the month this change takes effect, you will need to coordinate with your Social Security office to set up your Medicare Parts A & B benefits effective the first of the month in which you turn age 65. You will also work with Via Benefits in this 90-day period to establish your Health Reimbursement Account (HRA) funding from the Conference which will help offset your continued out-of-pocket health care expenses. This change in primary insurance coverage will not impact your conference relationship nor your appointment to Medical Leave. You will receive correspondence from the Conference Benefits Team in advance of this change which will provide your specific details and next action steps.

Insurance Participants Who Retired Under Age 65 Will Have a Benefits Change At Age 65

Your post-retirement health plan funding has been determined using years of NC pension credit accrued through June 30, 2009 plus the number of months of active enrollment in the Conference insurance plan between July 1, 2009 and your retirement date. Retirees must have a minimum of 180 months of combined credit over the course of their career to receive the minimum funding in retirement. Refer to the Board of Pension report in the Conference Journal for more details.

Upon attaining age 65, Medicare will become your primary insurance carrier and the NC Conference will begin funding your Health Reimbursement Account (HRA) administered through Via Benefits. This account is used to aid in the purchase of individual plans or Medicare supplemental plans on the open market and to offset your out-of-pocket health care expenses. You may consult a Via Benefits advisor for assistance in choosing a plan. Within 90 days prior to the first of the month in which you turn age 65, you must contact Medicare to sign up for Parts A & B. Also during this time participants and their eligible spouses must both contact Via Benefits at 855-801-9759 to activate both of their HRAs in a timely manner.

Retirees Over Age 65, Learn More About Your Health Reimbursement Account (HRA)

The NC Board of Pension established a Health Reimbursement Account arrangement effective January 1, 2014, for eligible participants. Each plan year (which is January – December), funding is provided based on the retiree’s specific retirement criteria. This funding is to be used to reimburse participants for eligible medical expenses with no tax implication to the participant. Via Benefits is the vendor chosen by the Conference to administer your HRA. This is a reimbursement account. You must provide proof that you have paid the eligible expense in order to be reimbursed.

Visit the Retiree Health page for current funding amounts.

How Do I Get My Money?

- Premium reimbursements can be handled by:

- Completing and submitting a paper claim form each month, or

- Your insurance company may be willing to submit an electronic payment file on your behalf

- Out of Pocket Expenses may be filed using a paper claim form or through your online account at my.viabenefits.com/nccumc

- You can receive your HRA reimbursements by check or direct bank deposit

What Do I Need To File A Claim?

- If you are filing a claim for premium reimbursement, you must provide documentation (such as your monthly payment invoice) from your insurance carrier that provides:

- The covered participant’s name. The document must show each covered person’s name

- The name of the insurance carrier

- The date range of the coverage (effective date, end date)

- A description of the type of coverage

- The premium amount you paid for each person

- If you are filing a claim for out of pocket expenses, you must provide documentation that shows:

- The name of the patient

- The name of the doctor or medical facility

- The date of service

- The type of service

- The amount you paid

- Helpful documents to include with your out of pocket expense claim:

- The discharge document that is provided to you at the time you leave the doctor’s office. If you are not offered a copy at the time that you check out, simply ask for a copy.

- The Explanation of Benefits that Medicare or your insurance carrier provides showing the amount that was not covered by insurance

- Proof of payment such as a canceled check, credit card receipt, or receipt from the provider stating the amount that you paid for your service

- Documents that indicate that insurance is pending are not acceptable

What Other Helpful Tips Do You Recommend?

- Sign and date all claim forms.

- Keep a copy of everything you submit.

- Submit legible copies of your receipts (retain the originals for your records).

What Is An HRA Eligible Reimbursable Expense?

- Premiums paid for medical insurance plans such as:

- Medicare Supplement, Medigap, Medicare Advantage, Medicare D pharmacy plans

- Medicare Part B (this is withheld from your Social Security each month)

- Vision plans or Dental plans

- Out of Pocket expenses such as:

- Doctor’s office visit co-pays

- Deductibles

- Eyeglasses or contacts

- IRS qualified expenses (see IRS Publication 502 for more details) such as, but not limited to:

- Abdominal supports • Acupuncture • Air conditioner (when necessary for relief from difficulty in breathing) • Alcoholism treatment • Ambulance • Anesthetist • Arch supports • Artificial limbs • Autoette (when used for relief of sickness/disability) • Birth Control Pills (by prescription) • Blood tests • Blood transfusions • Braces • Cardiographs • Chiropractor • Christian Science Practitioner • Contact Lenses • Contraceptive devices (by prescription) • Convalescent home (for medical treatment only) • Crutches • Dental Treatment • Dental X-rays • Dentures • Dermatologist • Diagnostic fees • Diathermy • Drug addiction therapy • Drugs (prescription) • Elastic hosiery (prescription) • Eyeglasses • Fees paid to health institute prescribed by a doctor • FICA and FUTA tax paid for medical care service • Fluoridation unit • Guide dog • Gum treatment • Gynecologist • Healing services • Hearing aids and batteries • Hospital bills • Hydrotherapy • Insulin treatment • Lab tests • Lead paint removal • Legal fees • Lodging (away from home for outpatient care) • Metabolism tests • Neurologist • Nursing (including board and meals) • Obstetrician • Operating room costs • Ophthalmologist • Optician • Optometrist • Oral surgery • Organ transplant (including donor’s expenses) • Orthopedic shoes • Orthopedist • Osteopath • Oxygen and oxygen equipment • Pediatrician • Physician • Physiotherapist • Podiatrist • Postnatal treatments • Practical nurse for medical services • Prenatal care • Prescription medicines • Psychiatrist • Psychoanalyst • Psychologist • Psychotherapy • Radium Therapy • Registered nurse • Special school costs for the handicapped • Spinal fluid test • Splints • Sterilization • Surgeon • Telephone or TV equipment to assist the hard-of-hearing • Therapy equipment • Transportation expenses (relative to health care) • Ultra-violet ray treatment • Vaccines • Vasectomy • Vitamins (if prescribed) • Wheelchair • X-rays

Who Can I Call For More Help?

- Via Benefits Customer Support: 855-801-9759 or my.viabenefits.com/nccumc

- NC Conference Benefits Team: 800-849-4433 or benefitsteam@nccumc.org

The Shepherd’s Fund

Learn more about The Shepherd’s Fund, a benevolent grant to assist retirees and their spouses as well as medical leave members and their spouses. There is a broad list of qualifiying expenses such as medical, dental, hearing aids, funeral expenses and more!

Ways to Wellness

The NC Conference offers a wellness program to support retired clergy and their spouses in making their personal wellness a priority. The programs described on our Wellness webpage are offered as resources on your journey towards healthy living.

Bonus Facts

More resources are available on the Treasurer’s Office Downloads webpage.

Your Benefits Team is available to provide enrollment/change forms and answer all your insurance questions! Contact us at benefitsteam@nccumc.org.